Unlocking the Secrets of Norfolk Southern Stock: A Comprehensive Guide to Price Forecasting Models

Understanding the complexities of the stock market is crucial for investors seeking financial success. Price forecasting models play a vital role in predicting future stock prices, enabling investors to make informed decisions. This article delves into the intricacies of price forecasting models, specifically focusing on Norfolk Southern Corporation (NSC),a prominent company within the Fortune 500. We will explore various modeling techniques, their advantages and drawbacks, and how to interpret their results effectively.

Price forecasting models are statistical or analytical tools designed to predict future stock prices based on historical data. They leverage mathematical equations, algorithms, and statistical techniques to identify patterns and trends that can influence price movements. While no model can guarantee perfect accuracy, they provide valuable insights into potential price directions.

Numerous price forecasting models exist, each with its unique approach and assumptions. Common models include:

4.5 out of 5

| Language | : | English |

| File size | : | 1469 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 55 pages |

| Lending | : | Enabled |

Technical analysis focuses solely on historical price data, identifying patterns and trends using charts and indicators. It assumes that past price movements can provide clues about future behavior.

Fundamental analysis examines a company's financial statements, economic indicators, and industry trends to assess its intrinsic value. It assumes that a stock's price should reflect the underlying value of the company.

Quantitative models utilize statistical techniques to analyze large datasets. They often rely on regression analysis, machine learning, and econometric methods to identify relationships between various factors and stock prices.

Norfolk Southern Corporation (NSC) is a leading transportation company in North America, operating a vast rail network. Its stock is actively traded on the New York Stock Exchange (NYSE) under the ticker symbol NSC. To forecast NSC stock prices, analysts employ a combination of price forecasting models.

Technical analysts closely monitor NSC's stock charts, identifying support and resistance levels, moving averages, and technical indicators such as the relative strength index (RSI) and moving average convergence divergence (MACD). These patterns can provide insights into potential price trends and reversal points.

Fundamental analysts assess NSC's financial performance, reviewing key metrics such as revenue, earnings per share (EPS),profit margins, and return on equity (ROE). Industry trends, economic conditions, and regulatory changes are also considered to gauge the company's overall health and growth prospects.

Quantitative models leverage statistical techniques to analyze NSC's historical data and identify patterns. Regression analysis, time series analysis, and machine learning algorithms are employed to uncover relationships between NSC's stock price and various factors such as economic indicators, industry performance, and technical indicators.

Interpreting the results of price forecasting models requires careful consideration. It is important to remember that these models are not precise predictors but rather provide probabilistic estimates. Hence, investors should treat model outputs as potential scenarios rather than definitive outcomes.

Moreover, different models can yield varying results, reflecting different assumptions and methodologies. Analysts often combine insights from multiple models to gain a more comprehensive perspective.

While price forecasting models can be valuable tools, it is essential to exercise caution and adhere to best practices:

- Consider multiple models: Relying on a single model can lead to biased results. Compare outputs from different modeling approaches to get a more robust understanding.

- Understand model limitations: Each model has its strengths and weaknesses. Be aware of the assumptions and limitations inherent in each model.

- Use historical data wisely: Models are trained on historical data, which may not always reflect future market conditions. Be cautious when extrapolating results into the future.

- Seek professional advice: Consult with experienced financial advisors to guide your investment decisions and interpret model outputs effectively.

Price forecasting models offer invaluable insights into potential stock price movements. By understanding the different types of models, their applications, and how to interpret their results, investors can enhance their decision-making process. The case of Norfolk Southern Corporation (NSC) exemplifies how a combination of technical, fundamental, and quantitative modeling can provide a comprehensive perspective on a stock's price trajectory.

Remember, price forecasting models are not infallible and should be used in conjunction with other investment research and analysis. By exercising caution, adhering to best practices, and seeking professional guidance when necessary, investors can harness the power of these models to navigate the complexities of the stock market and make informed investment decisions.

4.5 out of 5

| Language | : | English |

| File size | : | 1469 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 55 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Tracie Peterson

Tracie Peterson Simon Riggs

Simon Riggs Trisha Ashley

Trisha Ashley Sean F Johnston

Sean F Johnston Robert Sellers

Robert Sellers Sorkunde Olabarri Legarreta

Sorkunde Olabarri Legarreta Carl Anderson

Carl Anderson Thousand Times

Thousand Times Stephen Sanderson

Stephen Sanderson Yogesh Babar

Yogesh Babar Mike Bryon

Mike Bryon Ty M Bollinger

Ty M Bollinger Ivy Tang

Ivy Tang Youna Kim

Youna Kim Zuri Kaloki

Zuri Kaloki Tracey Miller Zarneke

Tracey Miller Zarneke Laura Allen

Laura Allen Peter Cook

Peter Cook Phil Attard

Phil Attard Trish Macgregor

Trish Macgregor

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Brett SimmonsUnlock the Power of Flexibility and Strength: A Comprehensive Exploration of...

Brett SimmonsUnlock the Power of Flexibility and Strength: A Comprehensive Exploration of... Joseph FosterFollow ·5.6k

Joseph FosterFollow ·5.6k Leslie CarterFollow ·15.4k

Leslie CarterFollow ·15.4k Glenn HayesFollow ·5.6k

Glenn HayesFollow ·5.6k James HayesFollow ·18.7k

James HayesFollow ·18.7k Raymond ChandlerFollow ·6.2k

Raymond ChandlerFollow ·6.2k Beau CarterFollow ·9.1k

Beau CarterFollow ·9.1k Jack LondonFollow ·11.5k

Jack LondonFollow ·11.5k Garrett PowellFollow ·10.9k

Garrett PowellFollow ·10.9k

Timothy Ward

Timothy WardSteamy Reverse Harem with MFM Threesome: Our Fae Queen

By [Author...

Cody Blair

Cody BlairThe Ultimate Guide to Energetic Materials: Detonation and...

Energetic materials are a fascinating and...

Kenzaburō Ōe

Kenzaburō ŌeProstitution, Modernity, and the Making of the Cuban...

By Emily A....

Kirk Hayes

Kirk HayesUnveil the Enchanting World of The Rape of the Lock by...

Alexander Pope's epic...

Ivan Turgenev

Ivan TurgenevTantric Quest: An Encounter With Absolute Love

Embark on a Tantric Quest to...

Gary Reed

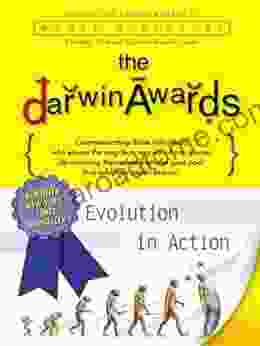

Gary ReedThe Darwin Awards: Evolution in Action

The Darwin Awards are a...

4.5 out of 5

| Language | : | English |

| File size | : | 1469 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 55 pages |

| Lending | : | Enabled |