Unlocking Profit Potential: A Comprehensive Guide to Price Forecasting Models for Mercer International Inc. (MERC) Stock on NASDAQ

In the dynamic and ever-evolving stock market, making informed investment decisions requires a deep understanding of market trends and the ability to accurately forecast future price movements. For savvy traders and investors, price forecasting models offer a powerful tool to gain valuable insights and unlock profit potential.

5 out of 5

| Language | : | English |

| File size | : | 1682 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

| Print length | : | 75 pages |

Introducing Mercer International Inc. (MERC) Stock

Mercer International Inc. (MERC) is a leading global pulp and paper company headquartered in Vancouver, Canada. Traded on the NASDAQ stock exchange, MERC stock has attracted the attention of investors seeking exposure to the pulp and paper industry. With a solid financial performance and a strong market position, MERC presents an attractive investment opportunity.

The Importance of Price Forecasting Models

Accurate price forecasting is crucial for successful trading and investing. By leveraging sophisticated models, traders and investors can:

- Identify potential trading opportunities

- Minimize risk and maximize returns

- Make informed investment decisions

- Stay ahead of market trends

Types of Price Forecasting Models

There are numerous price forecasting models available, each with its own strengths and weaknesses. The most common types include:

- Technical analysis models: These models use historical price data to identify patterns and trends, assuming that past performance can indicate future behavior.

- Fundamental analysis models: These models consider a company's financial performance, industry dynamics, and economic factors to forecast future stock prices.

- Quantitative models: These models use mathematical and statistical techniques to analyze large datasets and identify trading signals.

- Algorithmic trading models: These models automate the trading process based on pre-defined rules and algorithms, enabling faster and more efficient execution.

Advanced Price Forecasting Models for MERC Stock

For MERC stock specifically, several advanced price forecasting models have been developed to provide traders and investors with in-depth insights:

- Time series analysis model: This model analyzes historical price data to identify patterns and trends, using statistical techniques to forecast future prices.

- Autoregressive integrated moving average (ARIMA) model: This model combines time series analysis with regression analysis to forecast future prices more accurately.

- Machine learning model: This model uses artificial intelligence and machine learning algorithms to analyze large datasets and identify trading opportunities.

- Monte Carlo simulation model: This model uses random sampling techniques to simulate possible future price scenarios, providing a range of potential outcomes.

Benefits of Using Price Forecasting Models

Integrating price forecasting models into your trading and investment strategy offers numerous benefits:

- Reduced risk: By identifying potential price movements, investors can make more informed decisions and manage risk more effectively.

- Enhanced returns: Accurate forecasts can lead to timely entries and exits from trades, maximizing profit potential.

- Improved decision-making: Models provide objective and data-driven insights, removing emotional biases from investment decisions.

- Time efficiency: Automated models save time and effort by analyzing large datasets and identifying trading signals quickly.

Price forecasting models are an indispensable tool for traders and investors seeking to make informed decisions and unlock profit potential in the stock market. By leveraging advanced models tailored to MERC stock on NASDAQ, individuals can gain valuable insights into price movements and make more strategic investment choices. Remember, while models provide valuable guidance, they should be used in conjunction with other analysis methods and investment strategies to maximize returns and minimize risk.

For further information and access to comprehensive price forecasting models for MERC stock, please refer to the following resources:

- TradingView

- Barchart

- MarketWatch

5 out of 5

| Language | : | English |

| File size | : | 1682 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

| Print length | : | 75 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Sharon Purtill

Sharon Purtill Sarah E Truman

Sarah E Truman Walter Brueggemann

Walter Brueggemann Zijin Chen

Zijin Chen Trevor Hoppe

Trevor Hoppe Tim Cliss

Tim Cliss Nathan Lewis

Nathan Lewis Yoga Wheel Club

Yoga Wheel Club Jesse J Holland

Jesse J Holland 2013th Edition

2013th Edition Sophie Hardy

Sophie Hardy Sonia Shade

Sonia Shade Varun Bhartia

Varun Bhartia Victor Gioncu

Victor Gioncu Susan Bartlett Foote

Susan Bartlett Foote Whoopi Goldberg

Whoopi Goldberg Stephen Lucas

Stephen Lucas Shannon Medisky

Shannon Medisky Zilin Wang

Zilin Wang Yan Lin

Yan Lin

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

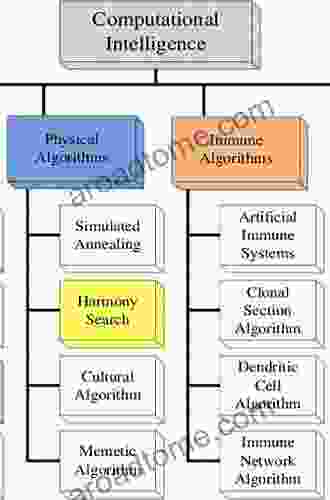

Carlos FuentesUnveiling the Secrets of Computational Intelligence: Concepts, Methods, and...

Carlos FuentesUnveiling the Secrets of Computational Intelligence: Concepts, Methods, and...

Jorge Luis BorgesParkinson's Disease: An Issue of Clinics in Geriatric Medicine - The Clinics

Jorge Luis BorgesParkinson's Disease: An Issue of Clinics in Geriatric Medicine - The Clinics Sean TurnerFollow ·9.1k

Sean TurnerFollow ·9.1k Jesus MitchellFollow ·13.5k

Jesus MitchellFollow ·13.5k Zachary CoxFollow ·18.5k

Zachary CoxFollow ·18.5k Avery SimmonsFollow ·19.2k

Avery SimmonsFollow ·19.2k Brennan BlairFollow ·4.2k

Brennan BlairFollow ·4.2k Greg CoxFollow ·2k

Greg CoxFollow ·2k Jake PowellFollow ·18k

Jake PowellFollow ·18k Braeden HayesFollow ·15.1k

Braeden HayesFollow ·15.1k

Timothy Ward

Timothy WardSteamy Reverse Harem with MFM Threesome: Our Fae Queen

By [Author...

Cody Blair

Cody BlairThe Ultimate Guide to Energetic Materials: Detonation and...

Energetic materials are a fascinating and...

Kenzaburō Ōe

Kenzaburō ŌeProstitution, Modernity, and the Making of the Cuban...

By Emily A....

Kirk Hayes

Kirk HayesUnveil the Enchanting World of The Rape of the Lock by...

Alexander Pope's epic...

Ivan Turgenev

Ivan TurgenevTantric Quest: An Encounter With Absolute Love

Embark on a Tantric Quest to...

Gary Reed

Gary ReedThe Darwin Awards: Evolution in Action

The Darwin Awards are a...

5 out of 5

| Language | : | English |

| File size | : | 1682 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

| Print length | : | 75 pages |